The trucking industry is often referred to as the backbone of the American economy, with more than four million trucks and 3.5 million drivers responsible for moving 10.5 billion tons of freight across the country each year. Most of those drivers run between 400-600 miles each day they’re on the road, often ending their long day by topping up on fuel so they’re ready to roll the next morning.

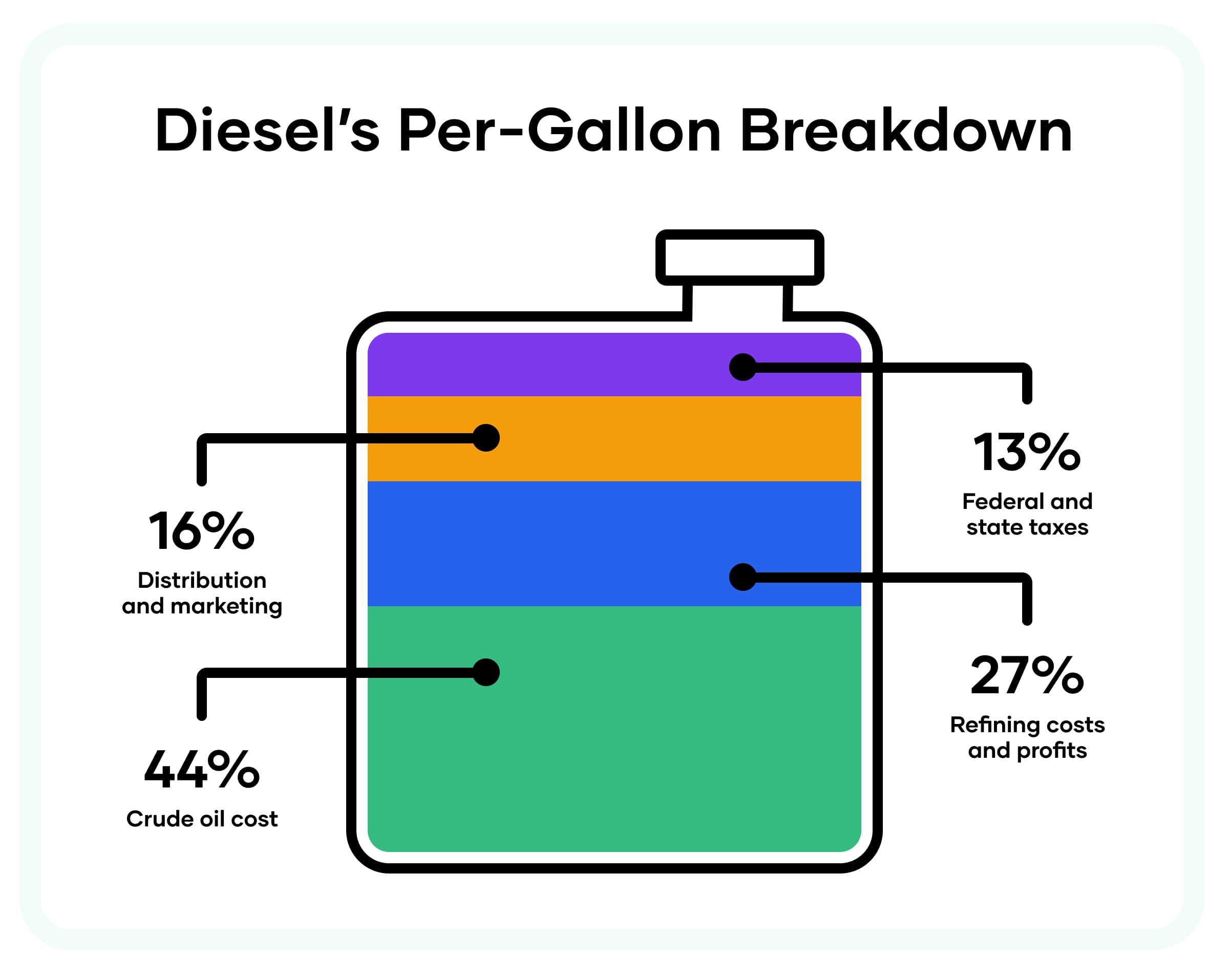

Diesel makes up about 28% of the cost of each mile driven, which means managing fuel spend and use is one of the most critical tasks for carriers and owner-operators. On average, a driver can spend as much as $70,000 every year refueling their truck with today’s high diesel prices, so reducing their fuel spend by just a few percent can save thousands. It’s critical that trucking professionals understand the costs involved in fueling their trucks, how to plan to optimize their fuel spend, and – importantly – how best to pay for fuel.

Fuel Payment Options and Fuel Discounts

The most common payment methods used for diesel purchases today include fuel cards for truckers and fleet checks, which are typically managed by carriers and distributed to drivers for use on the road. These allow fuel managers to track and authorize spending, as well as gain insights into spend efficiency if the payments are integrated in their transportation management system (TMS). Fuel cards and checks also give users a discount on fuel so operators can get the best fuel prices, with average savings ranging from $0.05-0.08 per gallon.

For all their advantages, however, billing cards are not a perfect solution. Physical cards are prime targets for fraud by card skimming and fuel theft, both of which are on the rise across the country. Getting the cards into drivers’ hands can also be challenging – particularly for widely dispersed fleets. And for managers trying to take care of a fraud incident and get a new card approved and out to the affected driver, too much of their time is being spent dealing with the fallout of physical fuel cards.

The trucking industry is modernizing to keep up with the demands and opportunities of America’s modern economy, and it needs a modern solution for efficient, secure and fast fuel payments that support low and fair costs. Digital payment solutions offer precisely that, giving greater control to carriers, confidence to drivers and savings to businesses of all sizes.

Digital Payments vs Fuel Cards

Digital fuel payments are the future of trucking.

|

|

Fuel Cards

|

Fleet Checks

|

|

|---|---|---|---|

| Vulnerable to card skimming, fraud, and hacking |

|

|

|

| One-time digital codes that work at the pump and in-store |

|

|

|

| Centralized reporting for all fuel and other OTR transactions |

|

|

|

| Fraud prevention through customizable policies and prompts |

|

|

|

| Instant activation for your entire fleet using a mobile app |

|

|

|

| Geofencing for accurate location verification on transactions |

|

|

|

Driving Efficiency

Through the pandemic, trucking remained an essential business, delivering everyday items as well as critical supplies across the nation. Now, as the industry looks to the post-pandemic future, carriers and owner-operators are facing both new and known challenges, from rising costs and driver shortages to global supply chain disruption and inflation.

As the economy evolves in uncertain times, it’s more important than ever to introduce efficiencies wherever possible to ensure your business stays competitive. Technology is key to this, as evidenced by TMS systems, ELDs, and more. Now modern digital payment networks like Relay can provide a quick path to improvements in the way we manage fuel expenses and other over-the-road costs.

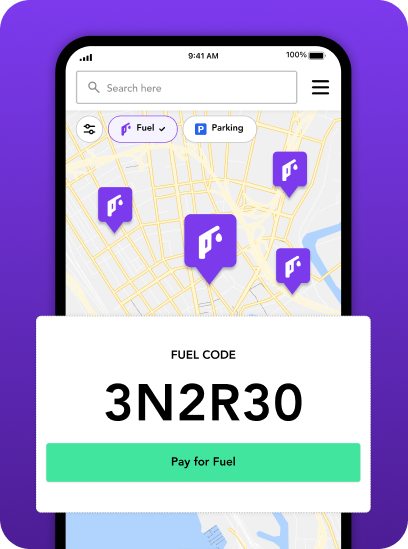

Relay’s digital payments are instant and secure, letting drivers speed through fuel stops as well as warehouse unloads, maintenance checks and more. The payments and processes are streamlined and instantly viewable by fuel or fleet managers, who also have controls like geofencing and preset limits to manage spend. Importantly, setup time for digital payments is minimal. A carrier can enable Relay for a fleet in under two hours, and drivers can begin using the app immediately – eliminating the need to get physical fuel cards out to drivers.

Discover 5 reasons digital payments are better

Surprise benefits of a fuel payments app

What makes up the price of diesel fuel

Eliminating Fuel Fraud

Fuel fraud is on the rise, and reports show that incidents of card skimming – a leading method of fuel fraud – increased more than 700% last year. The industry’s reliance on fleet fuel cards has left drivers vulnerable to fraud at truck stops nationwide, which is estimated to cost trucking companies millions every month.

Fully digital payments help eliminate truck stop fuel card fraud by eliminating cards. Payments are managed directly through the Relay network, using single-use RelayCodes to authorize purchases. So fraudsters don’t get the chance to steal account details in the first place.

In addition to keeping existing revenue secure, digital payments also save carriers and owner-operators the time and resources required to deal with incidents of fraud. Relay's detailed fuel reports means office staff are free to focus on their primary responsibilities, rather than spending their time filing incidents, completing paperwork, and getting new cards approved and sent out to truck drivers.

Fuel Fraud & How Carriers Are Fighting It

Avoiding common types of fuel fraud

Tips for avoiding fuel card fraud

Delivering Better Fuel Payments

Streamlining payments for critical expenses like fuel, scales, lumpers, parking and other over-the-road costs is essential to running an efficient, competitive trucking business. And digital payment solutions like Relay’s are making it easy for carriers, owner-operators and even individual drivers to gain greater control over their costs and processes.

With a quick setup and easy-to-use app, Relay enables a better payment experience with quick benefits for the business. This can also contribute to an improved relationship with drivers and vendors, and help boost driver retention – a key additional benefit given the current industry shortage. For these reasons and more, it’s clear the future of trucking will rely on digital fuel payments.

Technology provides a competitive edge in trucking

Digital payments help carriers cut costs

FUEL SAVINGS CALCULATOR

Save money using Relay for your fuel payments.

Whether using your negotiated merchant discounts or signing up for the Relay Clutch Program, you'll save money by eliminating fuel fraud through Relay's digital payments.

Frequently Asked Questions

-

WEX: Network of 45,000 merchants and automatic expense tracking and reporting

-

DAT One: Excellent fuel discounts plus low or no transaction fees

-

Fuelman: Great for smaller fleets with valuable cost-control flexibility

-

Relay: Offers virtual and physical cards for greater security

To apply for a fuel card, you should:

-

Evaluate your fleet needs and look for cards with appropriate network coverage, discounts and fees.

-

Collect required business information, financial statements and tax documents, including your EIN and proof of insurance.

-

For most cards, you will need a minimum credit score of 580, but this number will vary depending on the option you’re applying for.